Luk Enterprises Corp. (LEC) manufactures and distributes high quality bicycles. In 2019, as part of a promotional

Question:

Luk Enterprises Corp. (LEC) manufactures and distributes high quality bicycles. In 2019, as part of a promotional campaign, LEC offered a three-year warranty on all products it sells.

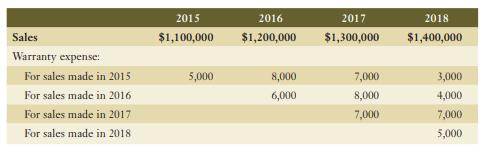

The company engaged new auditors in 2018. During the course of its investigation, the CPA firm inquired about the $19,000 charged to warranty expense during 2018 (before the launch of the warranty program). LEC explained that, while it had not previously offered a formal warranty, the company’s longstanding policy had been to repair or replace defective parts on a no-charge basis for three years from date of purchase. It charged the cost of the labour and parts at time of service to warranty expense. Pertinent information follows:

LEC estimates that the cost of the warranty program is 2% of sales. Its tax rate is 20%. The general ledger for 2018 has not yet been closed.

Required:

a. Briefly explain the nature of the accounting change and how it must be accounted for. Assume that all amounts are material.

b. Record any adjusting journal entries required to correct LEC’s books. Include the effect of income taxes.

Step by Step Answer: