Question: Modern Electronics Inc. (MEI) is a retailer that sells televisions, audio systems, computers, gaming consoles, related accessories, and appliances such as washing machines. Since its

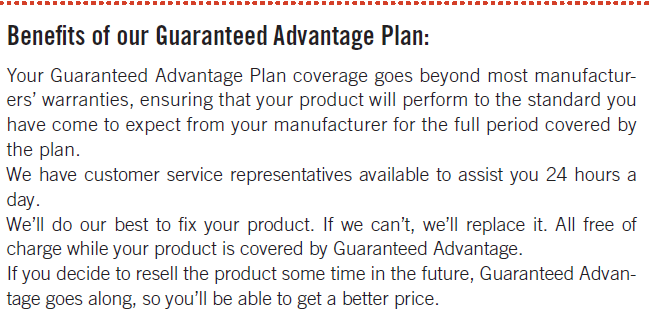

Many of the products stocked by MEI have warranties provided by the manufacturer, typically ranging from 90 days to one year. In addition to these manufacturer€™s warranties, MEI offers its customers, for a fee, €œGuaranteed Advantage Plans€ (GAPs). The box below provides a description of the Guaranteed Advantage Plan.

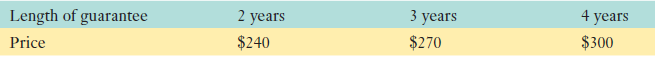

The fee and the coverage under the Guaranteed Advantage Plan differ according to the type of product and the option chosen by the customer. As a representative example, MEI offers the following coverage for a $1,500 television:

Competitors such as Best Buy and Future Shop also offer similar service plans. The GAPs are highly profitable for MEI. On average, the cost of fulfilling the guarantee is well under a third of the fee charged to the customer. Because of this low cost, the company is considering a short-term promotion whereby customers would receive, for no additional charge, the shortest GAP available for the product purchased. The customer can obtain a longer GAP by paying the differential. In the above example, a customer who purchases the $1,500 television would receive the two-year plan for free, but could pay $60 to obtain the four-year coverage.

Required:

Assume that it is the first year that the company has offered the Guaranteed Advantage Plans. As the company€™s controller, prepare a memo to MEI€™s CFO explaining the accounting issues surrounding the GAP and how it affects the accounting for products sold. Assume that the company follows the guidance provided by IFRS.

Benefits of our Guaranteed Advantage Plan: Your Guaranteed Advantage Plan coverage goes beyond most manufactur- ers' warranties, ensuring that your product will perform to the standard you have come to expect from your manufacturer for the full period covered by the plan. We have customer service representatives available to assist you 24 hours a day. We'll do our best to fix your product. If we can't, we'll replace it. All free of charge while your product is covered by Guaranteed Advantage. If you decide to resell the product some time in the future, Guaranteed Advan- tage goes along, so you'll be able to get a better price. 3 years 4 years Length of guarantee Price 2 years $240 $270 $300

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

To CFO From Controller Subject Impact of Product Service Plan on accounting for products sold The accounting issues relating to the Product Service Plan PSP or the Plan principally concern the transfe... View full answer

Get step-by-step solutions from verified subject matter experts