Question: Oculus is a proprietorship that produces a specialized type of round window. It is after the fiscal year-end for 2019, and the owner has drafted

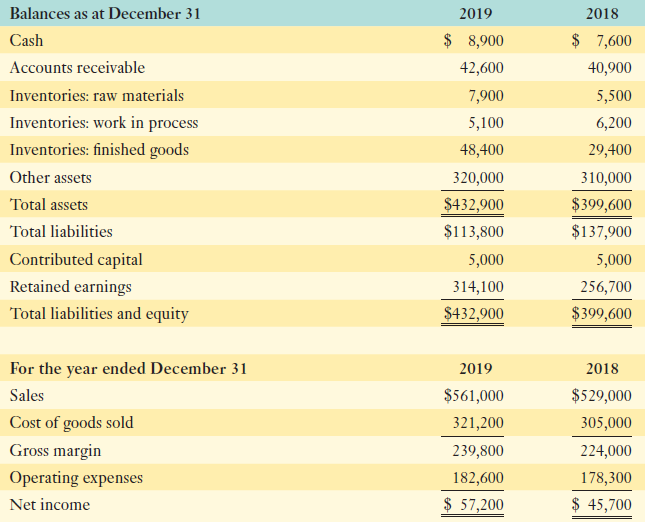

Oculus is a proprietorship that produces a specialized type of round window. It is after the fiscal year-end for 2019, and the owner has drafted the financial statements for the business for presentation to the bank and for tax purposes. The following provides a summary of those financial statements, along with comparative information for the prior year:

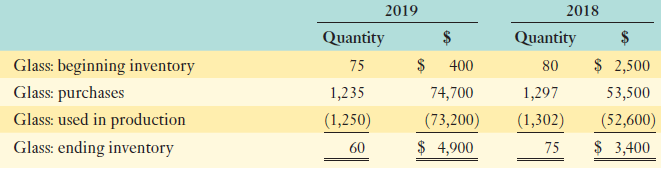

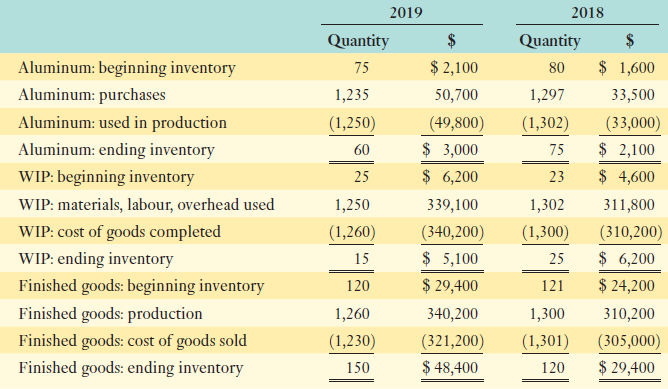

Raw materials consist of glass and aluminum. Due to their nature, these inventories cannot be specifically identified. Consequently, Oculus has used the first-in, first-out (FIFO) method for all of its inventories. Oculus uses a periodic inventory system, and the above financial information has been prepared using FIFO.

Input prices had been reasonably stable prior to 2018. However, as a result of rapidly rising prices for raw material inputs, the owner of Oculus feels that the FIFO method is overstating income. He wonders whether and by how much his financial results would change if he were to use the weighted-average cost method for inventories. To help address this issue, he has assembled additional information on the inventories for Oculus (raw material quantities are expressed in units equivalent to one standard finished window):

Required:

Prepare the revised balance sheets and income statements for Oculus under the weighted average cost method.

Balances as at December 31 2019 2018 $ 8,900 $ 7,600 Cash Accounts receivable 42,600 40,900 Inventories: raw materials 7,900 5,500 Inventories: work in process 5,100 6,200 Inventories: finished goods 48,400 29,400 Other assets 320,000 310,000 $432,900 $399,600 Total assets $137,900 Total liabilities $113,800 Contributed capital 5,000 5,000 Retained earnings 314,100 256,700 $399,600 Total liabilities and equity $432,900 For the year ended December 31 2019 2018 $561,000 $529,000 Sales Cost of goods sold 321,200 305,000 Gross margin 239,800 224,000 Operating expenses 182,600 178,300 $ 57,200 $ 45,700 Net income 2019 2018 Quantity Quantity 80 Glass: beginning inventory Glass: purchases Glass: used in production Glass: ending inventory 75 $ 400 74,700 $ 2,500 1,235 (1,250) 1,297 (73,200) $ 4,900 53,500 (52,600) $ 3,400 (1,302) 60 75

Step by Step Solution

3.55 Rating (165 Votes )

There are 3 Steps involved in it

It is important to note that a change from FIFO to weightedaverage cost would be a change in accounting policy Such changes must be reflected retrospe... View full answer

Get step-by-step solutions from verified subject matter experts