On July 31, 2020, Mexico Company paid $3 million to acquire all of the common shares of

Question:

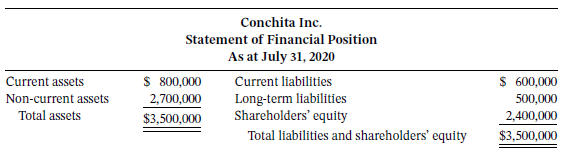

On July 31, 2020, Mexico Company paid $3 million to acquire all of the common shares of Conchita Incorporated, which became a division of Mexico. Conchita reported the following statement of financial position at the time of the acquisition.

It was determined at the date of the purchase that the fair value of the identifiable net assets of Conchita was $2,750,000. Over the next six months of operations, the newly purchased division experienced operating losses. In addition, it now appears that it will generate substantial losses for the foreseeable future. At December 31, 2020, the Conchita Division reports the following SFP-related information:

Current assets ......................................................................... $ 450,000Non-current assets (including goodwill recognizedin purchase) ............................................................................. 2,400,000Current liabilities ....................................................................... (700,000)Long-term liabilities .................................................................. (500,000)Net assets .............................................................................. $1,650,000

It is determined that the fair value of the Conchita Division as at December 31, 2020, is $1,850,000. The recorded amount for Conchita?s net assets (excluding goodwill) is the same as fair value, except for property, plant, and equipment, which has a fair value $150,000 above the carrying value. Assume that Mexico follows ASPE for financial reporting purposes.

Instructions

a. Calculate the amount of goodwill recognized, if any, on July 31, 2020.

b. Determine the loss on impairment, if any, to be recorded on December 31, 2020.

c. Assume that fair value of the Conchita Division is $1,600,000 instead of $1,850,000. Determine the loss on impairment, if any, to be recorded on December 31, 2020.

d. Prepare the journal entry to record the loss on impairment, if any, and indicate where the loss would be reported in the income statement.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy