On March 5, 2021, you were hired by Hemingway Inc., a closely held company, as a staff

Question:

On March 5, 2021, you were hired by Hemingway Inc., a closely held company, as a staff member of its newly created internal auditing department. While reviewing the company?s records for 2019 and 2020, you discover that no adjustments have yet been made for the following items. Items

1. Interest income of $14,100 was not accrued at the end of 2019. It was recorded when received in February 2020.

2. A computer costing $4,000 was expensed when purchased on July 1, 2019. It is expected to have a 4-year life with no salvage value. The company typically uses straight-line depreciation for all fixed assets.

3. Research and development costs of $33,000 were incurred early in 2019. They were capitalized and were to be amortized over a 3-year period. Amortization of $11,000 was recorded for 2019 and $11,000 for 2020.

4. On January 2, 2019, Hemingway leased a building for 5 years at a monthly rental of $8,000. On that date, the company paid the following amounts, which were expensed when paid.

Security deposit..................................$20,000First month?s rent...................................8,000Last month?s rent...................................8,000..............................................................$36,000

5. The company received $36,000 from a customer at the beginning of 2019 for services that it is to perform evenly over a 3-year period beginning in 2019. None of the amount received was reported as unearned revenue at the end of 2019.

6. Merchandise inventory costing $18,200 was in the warehouse at December 31, 2019, but was incorrectly omitted from the physical count at that date. The company uses the periodic inventory method.

Instructions

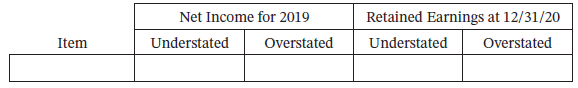

Indicate the effect of any errors on the net income figure reported on the income statement for the year ending December 31, 2019, and the retained earnings figure reported on the balance sheet at December 31, 2020. Assume all amounts are material, and ignore income tax effects. Using the following format, enter the appropriate dollar amounts in the appropriate columns. Consider each item independent of the other items. It is not necessary to total the columns on the grid.

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel