Question: Pension data for Barry Financial Services Inc., include the following: Required: 1. Determine pension expense for 2021.2. Prepare the journal entries to record? (a) Pension

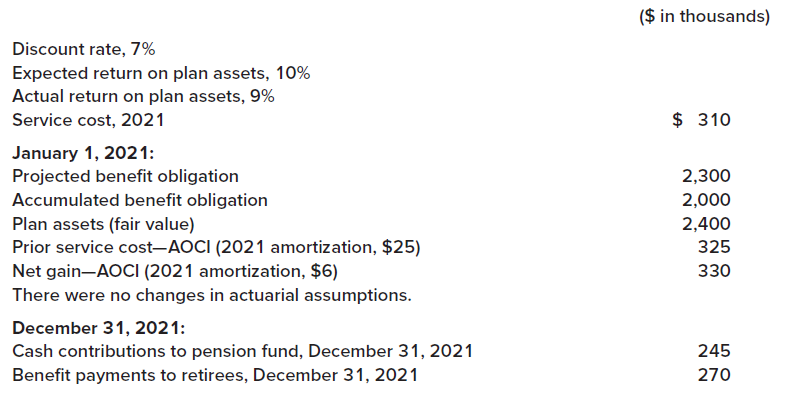

Pension data for Barry Financial Services Inc., include the following:

Required:1. Determine pension expense for 2021.2. Prepare the journal entries to record?

(a) Pension expense

(b) Gains and losses (if any)

(c) Funding,

(d) Retiree benefits for 2021.

($ in thousands) Discount rate, 7% Expected return on plan assets, 10% Actual return on plan assets, 9% $ 310 Service cost, 2021 January 1, 2021: Projected benefit obligation Accumulated benefit obligation Plan assets (fair value) Prior service cost-AOCI (2021 amortization, $25) Net gain-AOCI (2021 amortization, $6) There were no changes in actuarial assumptions. 2,300 2,000 2,400 325 330 December 31, 2021: Cash contributions to pension fund, December 31, 2021 Benefit payments to retirees, December 31, 2021 245 270

Step by Step Solution

3.52 Rating (172 Votes )

There are 3 Steps involved in it

Requirement 1 in 000s Service cost 310 Interest cost 7 x 2300 161 Expected return on the plan assets 216 actual plus 24 loss 240 Amortization of prior ... View full answer

Get step-by-step solutions from verified subject matter experts