Question: PEP Corporation has a defined benefit pension plan. As of January 1, the following balances exist: For the year ended December 31, the current service

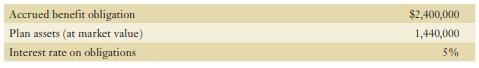

PEP Corporation has a defined benefit pension plan. As of January 1, the following balances exist:

For the year ended December 31, the current service cost as determined by an appropriate actuarial cost method was $330,000. Improvements in benefits created a past service cost of $800,000. A change in actuarial assumptions created a gain of $15,000 in the year. The expected return on plan assets was $72,000; however, the actual return is $70,000. PEP paid $325,000 to the pension trustee in December.

Required:

Prepare the journal entries for the pension for the year.

Accrued benefit obligation Plan assets (at market value) Interest rate on obligations $2,400,000 1,440,000 5%

Step by Step Solution

3.57 Rating (164 Votes )

There are 3 Steps involved in it

Recording current service cost Debit Pension Expense 330000 Credit Accrued Pension Liability 330000 ... View full answer

Get step-by-step solutions from verified subject matter experts