Question: Pfizer Inc., a global pharmaceutical company, offers several different types of stock-based compensation to its employees. Pfizer reports under U.S. GAAP. Use the disclosures provided

Pfizer Inc., a global pharmaceutical company, offers several different types of stock-based compensation to its employees. Pfizer reports under U.S. GAAP. Use the disclosures provided in Exhibit 19.3 to answer the following questions.

Required

a. What types of stock compensation plans does Pfizer offer?

b. What was the total expense related to these plans in 2019, 2018, and 2017? What is the expense related to stock-based compensation as a percentage of net income? Pfizer’s net income was $16,273, $11,153, and $21,308 million in 2019, 2018, and 2017, respectively.

c. How many shares of restricted stock units were granted in 2019? What is the vesting period? What is amount of compensation expense that will be recognized over the vesting period? If the restricted stock units were granted on January 1, 2019, what is the deferred compensation expense related to restricted stock units in 2019? How many shares were forfeited?

d. Are the stock options awards equity or liability classified? How many options were granted in 2019? What is the entry when the grant is made? What is the vesting period? How many options were forfeited and expired? If Pfizer’s average stock price during the year was $39.95 per share, can you give a reason why the options expired? What is the compensation expense related to stock options at the end of 2019? Ignore forfeitures.

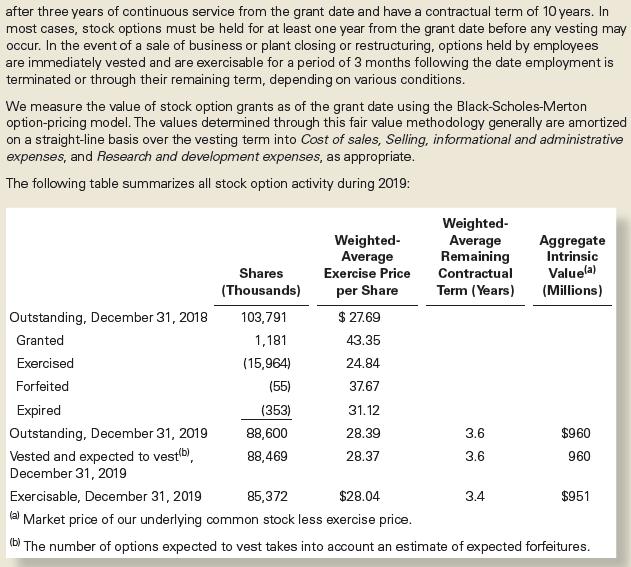

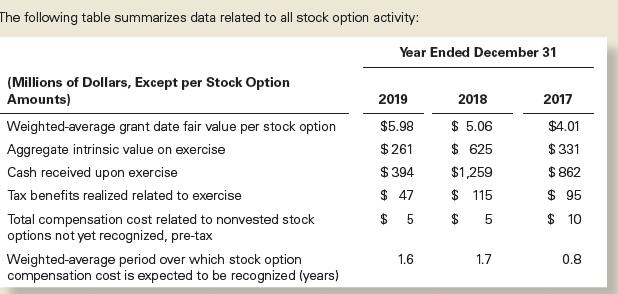

Data from EXHIBIT 19.3

EXHIBIT 19.3 Selected Footnote Disclosure of Stock-Based Compensation Disclosures, Pfizer Inc.’s Financial Statements, December 31, 2019

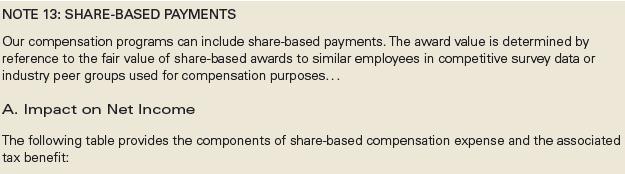

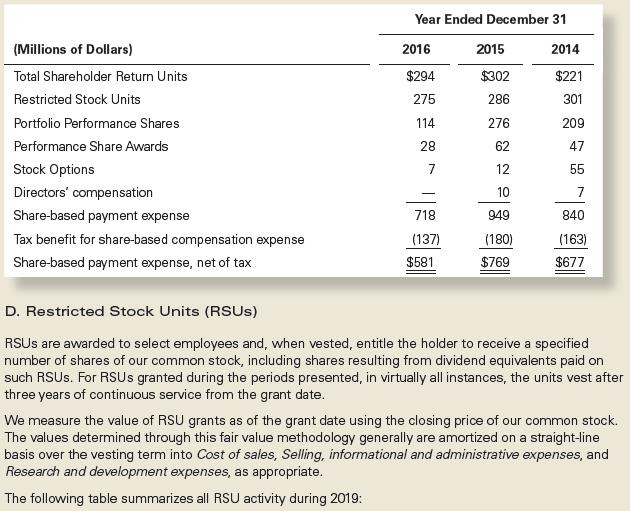

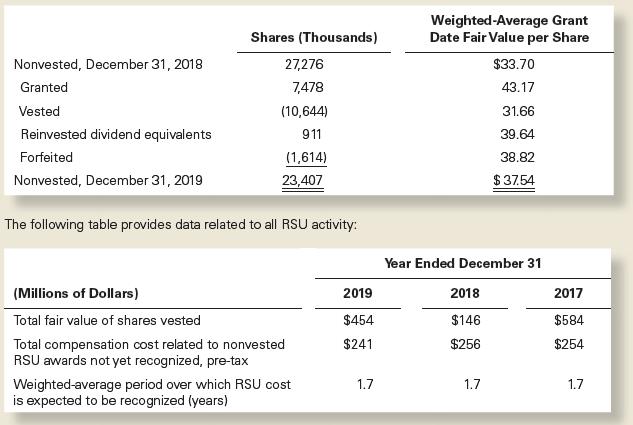

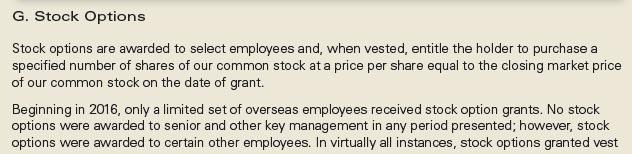

NOTE 13: SHARE-BASED PAYMENTS Our compensation programs can include share-based payments. The award value is determined by reference to the fair value of share-based awards to similar employees in competitive survey data or industry peer groups used for compensation purposes... A. Impact on Net Income The following table provides the components of share-based compensation expense and the associated tax benefit:

Step by Step Solution

3.27 Rating (168 Votes )

There are 3 Steps involved in it

a Pfizer offers several types of stockbased compensation including Total Shareholder Return Units Re... View full answer

Get step-by-step solutions from verified subject matter experts