Question: Quitzau Ltd. commenced operations on January 1, 2019. It has a December 31 year-end. The companys tax rate is 40%. The company offers a four-year

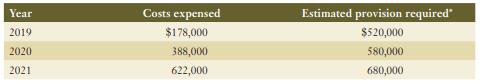

Quitzau Ltd. commenced operations on January 1, 2019. It has a December 31 year-end. The company’s tax rate is 40%. The company offers a four-year warranty on all the products it sells. Historically, it expensed warranty costs when incurred, rather than making a provision for them each year. During the audit of its 2021 year-end results, though, the external accountants discovered this oversight, and as they believed the amounts to be material, required Quitzau Ltd. to correct its error. Pertinent details of the warranty follow:

This is the amount that should have been originally recognized as a provision for warranty claims for the given year.

Assume that the rest of the adjusting entries, including those related to tax expense, have been journalized, but that closing entries have not yet been made.

Required:

a. Prepare the journal entry to retrospectively account for this correction of an error. Include the effect of income taxes.

b. Prepare the journal entry required on December 31, 2021, to adjust Quitzau Ltd.’s accounting records to properly recognize the provision for warranty expense required for 2021. Include the effect of income taxes.

Year 2019 2020 2021 Costs expensed $178,000 388,000 622,000 Estimated provision required" $520,000 580,000 680,000

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

a To retrospectively account for the correction of the error in recognizing warranty expense the fol... View full answer

Get step-by-step solutions from verified subject matter experts