Question: Refer to the data provided in the P 2111 for Arduous Company. Required: Prepare the statement of cash flows for Arduous Company using the indirect

Refer to the data provided in the P 21–11 for Arduous Company.

Required:

Prepare the statement of cash flows for Arduous Company using the indirect method

Data From P 21–11

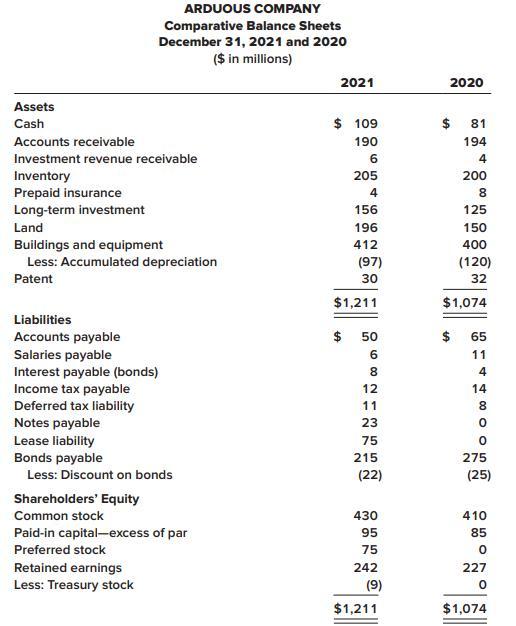

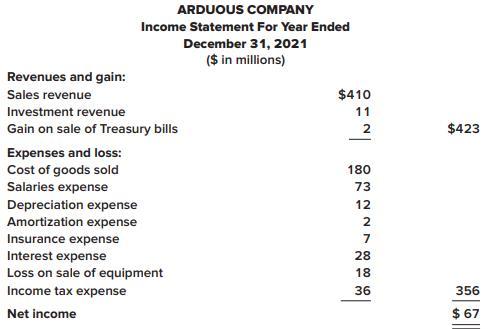

The comparative balance sheets for 2021 and 2020 and the income statement for 2021 are given below for Arduous Company. Additional information from Arduous’s accounting records is provided also.

Additional information from the accounting records:

a. Investment revenue includes Arduous Company’s $6 million share of the net income of Demur Company, an equity method investee.

b. Treasury bills were sold during 2021 at a gain of $2 million. Arduous Company classifies its investments in Treasury bills as cash equivalents.

c. Equipment originally costing $70 million that was one-half depreciated was rendered unusable by a flood. Most major components of the equipment were unharmed and were sold for $17 million.

d. Temporary differences between pretax accounting income and taxable income caused the deferred tax liability to increase by $3 million.

e. The preferred stock of Tory Corporation was purchased for $25 million as a long-term investment.

f. Land costing $46 million was acquired by issuing $23 million cash and a 15%, four-year, $23 million note payable to the seller.

g. The right to use a building was acquired with a 15-year lease agreement; present value of lease payments, $82 million. Annual lease payments of $7 million are paid at the beginning of each year starting January 1, 2021. h. $60 million of bonds were retired at maturity.

i. In February, Arduous issued a 5% stock dividend (4 million shares). The market price of the $5 par value common stock was $7.50 per share at that time. j. In April, 1 million shares of common stock were repurchased as treasury stock at a cost of $9 million.

Required:

Prepare the statement of cash flows for Arduous Company using the indirect method.

ARDUOUS COMPANY Comparative Balance Sheets December 31, 2021 and 2020 ($ in millions) 2021 2020 Assets Cash $ 109 $ 81 Accounts receivable 190 194 Investment revenue receivable 4 Inventory Prepaid insurance Long-term investment 205 200 4 156 125 Land 196 150 Buildings and equipment Less: Accumulated depreciation 412 400 (97) (120) Patent 30 32 $1,211 $1,074 Liabilities $ 50 Accounts payable Salaries payable Interest payable (bonds) Income tax payable Deferred tax liability Notes payable $ 65 6 11 8. 12 14 11 8. 23 Lease liability Bonds payable 75 215 275 Less: Discount on bonds (22) (25) Shareholders' Equity Common stock 430 410 Paid-in capital-excess of par 95 85 Preferred stock 75 242 Retained earnings Less: Treasury stock 227 (9) $1,211 $1,074

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Statement of cash flows Statement of cash flows is a financial statement which reports the inflow and outflow of cash of a company over a particular period of time It shows how the operating investing ... View full answer

Get step-by-step solutions from verified subject matter experts