Question: Refer to the facts in Problem 6-29. Data from 6-29. Assume that GFF uses a perpetual inventory system and the weighted-average cost flow assumption to

Refer to the facts in Problem 6-29.

Data from 6-29.

Assume that GFF uses a perpetual inventory system and the weighted-average cost flow assumption to account for its inventory. All purchases were made on account; all sales were for cash. GFF€™s supplier offered terms of 2/10, net 30. GFF recorded purchases at the gross amount. Additional information follows:

Purchase discount taken

Purchase #1 ..................................................... Yes

Purchase #2 ...................................................... No

Purchase #3 ...................................................... No

Sales price per unit

Sale #1 ....................................................... $24.00

Sale #2 ........................................................ 26.00

Sale #3 ........................................................ 25.50

Required:

a. Prepare journal entries to record:

i. The purchases of the inventory

ii. The sales of the inventory

iii. Payment of the accounts payables

b. Assume that GFF€™s opening and closing balances of its accounts receivable and payable for the year were $0. If the company uses the direct method to prepare its statement of cash flows, how much would be reported as a cash inflow from the sale of inventory? As a cash outflow from the purchase of inventory?

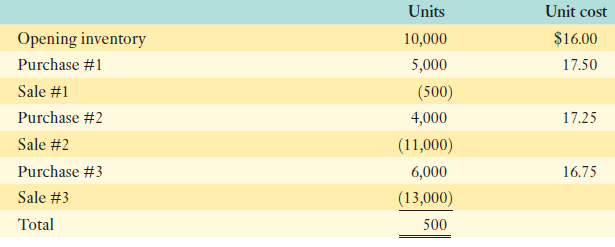

Unit cost Units Opening inventory $16.00 10,000 Purchase #1 5,000 17.50 Sale #1 (500) Purchase #2 4,000 17.25 Sale #2 (11,000) Purchase #3 6,000 16.75 Sale #3 (13,000) Total 500

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

a ai To record the purchase of the inventory P1 Dr Inventory 87500 Cr Accounts payable 87500 P2 D... View full answer

Get step-by-step solutions from verified subject matter experts