Question: Refer to the facts in problem P9-33. Data from P-33 Required: Assume Nikko uses the full cost method to account for exploration costs and complete

Refer to the facts in problem P9-33.

Data from P-33

Required:

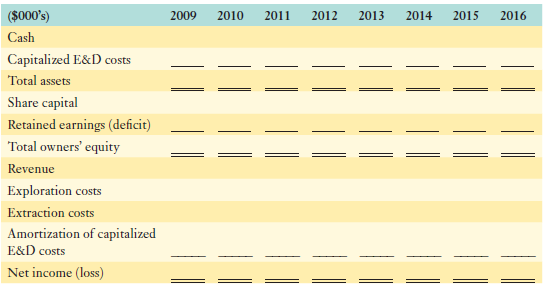

Assume Nikko uses the full cost method to account for exploration costs and complete the following table. Balance sheet amounts should be presented as at the year-end of December 31. Note also that when the ore is extracted, capitalized exploration and development (E&D) costs are amortized using a units-of-production depletion rate, which is the accumulated deferred costs divided by the estimated units of ore discovered (6,000,000 units).

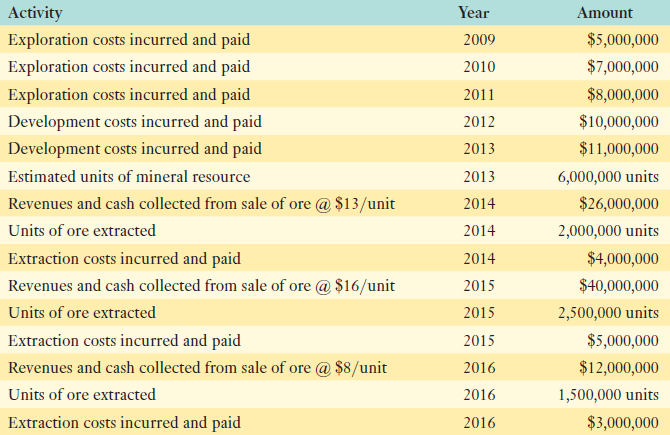

Activity Year Amount $5,000,000 Exploration costs incurred and paid 2009 $7,000,000 Exploration costs incurred and paid 2010 $8,000,000 Exploration costs incurred and paid 2011 $10,000,000 Development costs incurred and paid 2012 $11,000,000 Development costs incurred and paid 2013 Estimated units of mineral resource 6,000,000 units 2013 $26,000,000 Revenues and cash collected from sale of ore @ $13/unit 2014 Units of ore extracted 2,000,000 units 2014 Extraction costs incurred and paid $4,000,000 2014 $40,000,000 Revenues and cash collected from sale of ore @ $16/unit 2015 Units of ore extracted 2,500,000 units 2015 Extraction costs incurred and paid $5,000,000 2015 $12,000,000 Revenues and cash collected from sale of ore @ $8/unit 2016 Units of ore extracted 1,500,000 units 2016 $3,000,000 Extraction costs incurred and paid 2016 ($000's) 2009 2010 2011 2012 2013 2014 2015 2016 Cash Capitalized E&D costs Total assets Share capital Retained earnings (deficit) Total owners' equity Revenue Exploration costs Extraction costs Amortization of capitalized E&D costs Net income (loss)

Step by Step Solution

3.36 Rating (174 Votes )

There are 3 Steps involved in it

Fullcost method 000s 2009 2010 2011 2012 2013 2014 2015 2016 Cash 45000 38000 30000 20000 9000 31000 ... View full answer

Get step-by-step solutions from verified subject matter experts