Question: Romer Corporation began operations on January 1, 2019. The company decided to lease all plant assets rather than purchase them. Romer used the operating method

Romer Corporation began operations on January 1, 2019. The company decided to lease all plant assets rather than purchase them. Romer used the operating method for all leased assets in 2019 and 2020. On January 1, 2021, a new accountant joined the company and determined that the assets should be accounted for as finance leases following U.S. GAAP. Assume that this is a correction of an error. Income before tax and lease-related expenses in 2019, 2020, and 2021 are $580,000, $600,000, and $720,000, respectively. The tax rate is 40%.

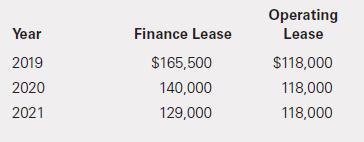

Lease-related expenses under the two methods follow:

Required

a. Determine the amount of the prior-period adjustment in the year of the correction.

b. Prepare partial comparative income statements for the years ended December 31, 2019 through 2021.

Year 2019 2020 2021 Finance Lease $165,500 140,000 129,000 Operating Lease $118,000 118,000 118,000

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

a Priorperiod adjustment The prior period adjustment net of tax t... View full answer

Get step-by-step solutions from verified subject matter experts