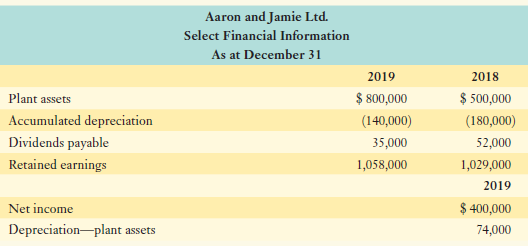

Question: Select financial information for Aaron and Jamie Ltd. appears below: The company issued 20,000 ordinary shares to a supplier in exchange for plant assets having

- The company issued 20,000 ordinary shares to a supplier in exchange for plant assets having a fair value of $200,000.

- The company sold equipment (plant assets) with a net book value of $125,000 for $90,000 cash.

- The company declared and issued an ordinary stock dividend valued at $30,000.

Required:

a. Determine the amount of cash inflows from investing that should be reported on the statement of cash flows.

b. Determine the amount of cash outflows from investing that should be reported on the statement of cash flows.

c. Determine the amount of cash dividends declared and paid during the year.

Aaron and Jamie Ltd. Select Financial Information As at December 31 2019 2018 $ 800,000 $ 500,000 Plant assets Accumulated depreciation (140,000) (180,000) Dividends payable 35,000 52,000 1,029,000 Retained earnings 1,058,000 2019 $ 400,000 Net income Depreciation-plant assets 74,000

Step by Step Solution

3.30 Rating (174 Votes )

There are 3 Steps involved in it

a The amount received from the sale of plant assets to be reported on the statement of cash flows is ... View full answer

Get step-by-step solutions from verified subject matter experts