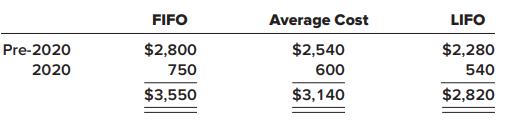

Question: Shown below are net income amounts as they would be determined by Weihrich Steel Company by each of three different inventory costing methods ($ in

Shown below are net income amounts as they would be determined by Weihrich Steel Company by each of three different inventory costing methods ($ in thousands).

Required:

1. Assume that Weihrich used FIFO before 2021, and then in 2021 decided to switch to average cost. Prepare the journal entry to record the change in accounting principle and briefly describe any other steps Weihrich should take to appropriately report the situation. (Ignore income tax effects.)

2. Assume that Weihrich used FIFO before 2021, and then in 2021 decided to switch to LIFO. Assume accounting records are inadequate to determine LIFO information prior to 2021. Therefore, the 2020 ($540) and pre-2020 ($2,280) data are not available. Prepare the journal entry to record the change in accounting principle and briefly describe any other steps Weihrich should take to appropriately report the situation. (Ignore income tax effects.)

3. Assume that Weihrich used FIFO before 2021, and then in 2021 decided to switch to LIFO cost. Weihrich’s records of inventory purchases and sales are not available for several previous years. Therefore, the pre-2020 LIFO information ($2,280) is not available. However, Weihrich does have the information needed to apply LIFO on a prospective basis beginning in 2020. Prepare the journal entry to record the change in accounting principle, and briefly describe any other steps Weihrich should take to appropriately report the situation. (Ignore income tax effects.)

FIFO Average Cost LIFO Pre-2020 $2,800 $2,540 $2,280 2020 750 600 540 $3,550 $3,140 $2,820

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Change in inventory costing method comparative income statements 1 Calculation of inventory value It is given that the inventory cost at book is 3550 ... View full answer

Get step-by-step solutions from verified subject matter experts