Question: South Olympia Systems (SOS) has a long-term project to install a complex information system for a client. The project has a contract price of $40

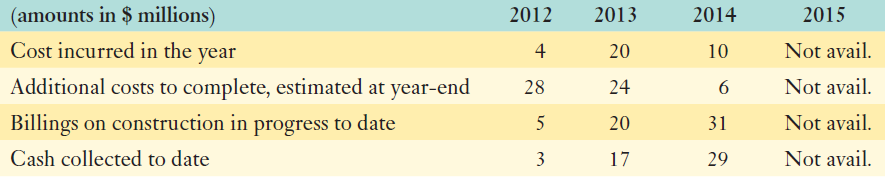

South Olympia Systems (SOS) has a long-term project to install a complex information system for a client. The project has a contract price of $40 million, and it was scheduled to be completed over four years from 2012 to 2015. SOS uses the percentage of completion method to account for long-term contracts using the cost-to-cost ratio. It is currently early 2015. The following table provides information relating to this project so far:

Required:

a. Compute the amount of revenue that SOS should recognize in each of 2012, 2013, and 2014.

b. The gross profit (loss) for the contract recognized in 2013 is a loss of $9 million. Compute the amount of gross profit for each of 2012 and 2014.

c. Prepare all the journal entries required in 2014, the third year of the contract.

(amounts in $ millions) Cost incurred in the year Additional costs to complete, estimated at year-end Billings on construction in progress to date 2014 2012 2013 2015 Not avail. Not avail. Not avail. Not avail. 4 20 10 28 24 6. 20 31 3 Cash collected to date 17 29

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

a Revenue complete x total revenue revenue previously recogni... View full answer

Get step-by-step solutions from verified subject matter experts