Southern Solar earned taxable income of $995,000 for the year ended December 31. As an environmental technology

Question:

Southern Solar earned taxable income of $995,000 for the year ended December 31. As an environmental technology company, Southern Solar’s income tax rate is only 20%. Additional information relevant to income taxes includes the following:

■Capital cost allowance of $350,000 exceeded accounting depreciation expense of $170,000 in the current year.

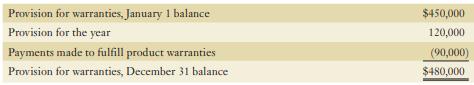

■ The company provides warranties on its solar panels for a period of five years. A summary of the current year’s transactions appears below:

■ During the year, the company sold a parcel of unused land. Proceeds on the sale were $1,500,000 while the purchase cost was $600,000. For tax purposes, one-half of capital gains is taxable.

Required:

Prepare the journal entries to record income taxes for Southern Solar.

Step by Step Answer: