The accounting staff of Holder Inc. has prepared the following post-retirement benefit worksheet. Unfortunately, several entries in

Question:

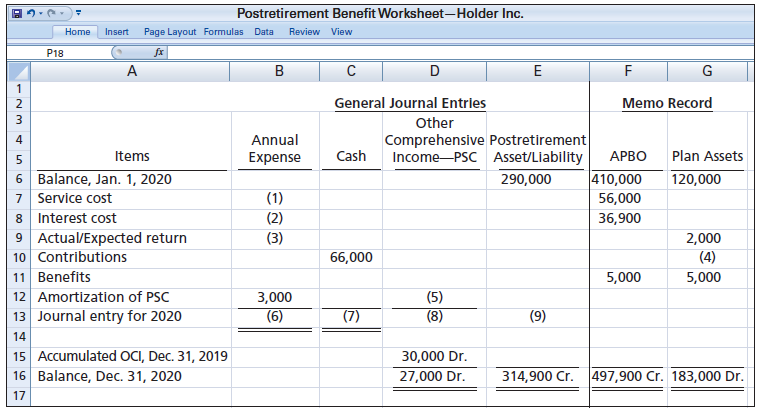

The accounting staff of Holder Inc. has prepared the following post-retirement benefit worksheet. Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in completing the worksheet and completing the accounting tasks related to the pension plan for 2020.

Instructions

a. Determine the missing amounts in the 2020 post-retirement worksheet, indicating whether the amounts are debits or credits.

b. Prepare the journal entry to record 2020 post-retirement expense for Holder Inc.

c. What discount rate is Holder using in accounting for the interest on its other post-retirement benefit plan? Explain.

Discount RateDepending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel