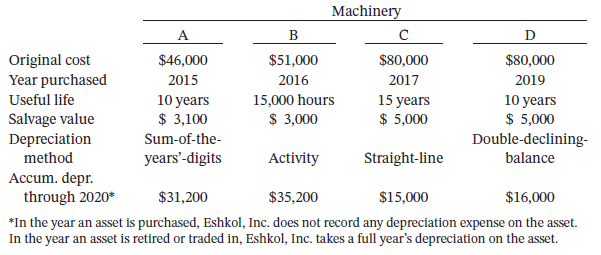

The following data relate to the Machinery account of Eshkol, Inc. at December 31, 2020. The following

Question:

The following data relate to the Machinery account of Eshkol, Inc. at December 31, 2020.

The following transactions occurred during 2021.

a. On May 5, Machine A was sold for $13,000 cash. The company?s bookkeeper recorded this retirement in the following manner in the cash receipts journal.

Cash.................................................13,000Machinery (Machine A).................................13,000

b. On December 31, it was determined that Machine B had been used 2,100 hours during 2021.

c. On December 31, before computing depreciation expense on Machine C, the management of Eshkol, Inc. decided the useful life remaining from January 1, 2021, was 10 years.

d. On December 31, it was discovered that a machine purchased in 2020 had been expensed completely in that year. This machine cost $28,000 and has a useful life of 10 years and no salvage value. Management has decided to use the double-declining-balance method for this machine, which can be referred to as ?Machine E.?

Instructions

Prepare the necessary correcting entries for the year 2021. Record the appropriate depreciation expense on the above-mentioned machines. No entry is necessary for Machine D.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel