Question: The following information relates to the defined benefit pension plan of Murry Corp. for the year ended December 31, 2023: There were no benefit payments

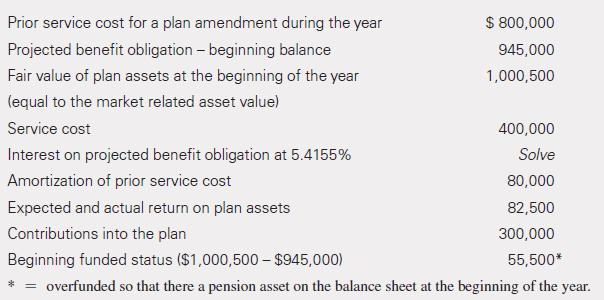

The following information relates to the defined benefit pension plan of Murry Corp. for the year ended December 31, 2023:

There were no benefit payments for the year.

Required:

a. Compute the total pension expense.

b. Prepare the journal entry to record pension expense for the year.

c. Determine the ending balances of the projected benefit obligation, plan assets, the pension asset or liability reported on the balance sheet, and accumulated other comprehensive income related to the pension plan.

Prior service cost for a plan amendment during the year Projected benefit obligation - beginning balance Fair value of plan assets at the beginning of the year (equal to the market related asset value) Service cost Interest on projected benefit obligation at 5.4155% Amortization of prior service cost * $ 800,000 945,000 1,000,500 Expected and actual return on plan assets Contributions into the plan Beginning funded status ($1,000,500 - $945,000) 55,500* overfunded so that there a pension asset on the balance sheet at the beginning of the year. = 400,000 Solve 80,000 82,500 300,000

Step by Step Solution

3.30 Rating (156 Votes )

There are 3 Steps involved in it

a b c Funded Status 2239500 1383000 856500UnderfundedTherefore there is a pe... View full answer

Get step-by-step solutions from verified subject matter experts