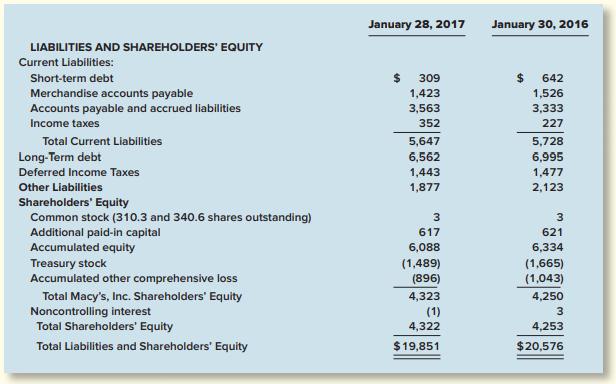

The following is a portion of the balance sheets of Macys, Inc. for the years ended January

Question:

The following is a portion of the balance sheets of Macy’s, Inc. for the years ended January 28, 2017 and January 30, 2016:

Required:

1. What is Macy’s debt to equity ratio for the year ended January 28, 2017?

2. What would Macy’s debt to equity ratio be if we excluded deferred tax liabilities from its calculation? What would be the percentage change?

3. What might be the rationale for not excluding long-term deferred tax liabilities from liabilities when computing the debt to equity ratio?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Question Posted: