Question: (This exercise is a variation of E 16?4, modified to have the asset fully depreciated in the year of purchase.) Ayres Services acquired an asset

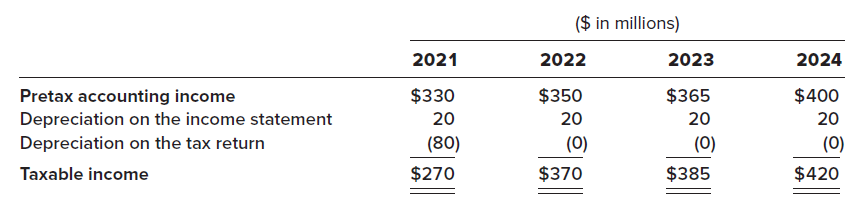

(This exercise is a variation of E 16?4, modified to have the asset fully depreciated in the year of purchase.) Ayres Services acquired an asset for $80 million in 2021. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). Ayers deducted 100% of the asset?s cost for income tax reporting in 2021. The enacted tax rate is 25%. Amounts for pretax accounting income, depreciation, and taxable income in 2021, 2022, 2023, and 2024 are as follows:

Required:For December 31 of each year, determine (a) The temporary book-tax difference for the depreciable asset and (b) The balance to be reported in the deferred tax liability account.

($ in millions) 2023 2021 2022 2024 Pretax accounting income Depreciation on the income statement Depreciation on the tax return Taxable income $330 $350 $365 $400 20 20 20 20 (80) (0) (0) (0) $270 $370 $385 $420

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

in millions December 31 Cost 2021 2022 2023 ... View full answer

Get step-by-step solutions from verified subject matter experts