Question: This is a variation of E 159 modified to assume lease payments are at the end of each period. Each of the three independent situations

This is a variation of E 15–9 modified to assume lease payments are at the end of each period.

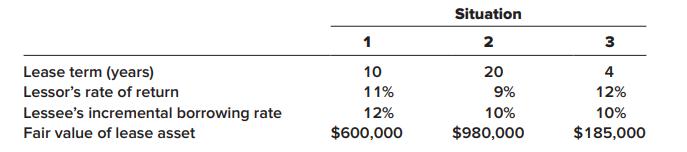

Each of the three independent situations below describes a finance lease in which annual lease payments are payable at the end of each year. The lessee is aware of the lessor’s implicit rate of return.

Required:

For each situation, determine:

a. The amount of the annual lease payments as calculated by the lessor.

b. The amount the lessee would record as a right-of-use asset and a lease liability.

Situation 1 2 3 Lease term (years) 10 20 4 Lessor's rate of return 11% 9% 12% Lessee's incremental borrowing rate 12% 10% 10% Fair value of lease asset $600,000 $980,000 $185,000

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Lease Lease is a legal agreement between two parties lessor and lessee in which the owner of the asset lessor allows another party lessee to use the a... View full answer

Get step-by-step solutions from verified subject matter experts