Question: [This problem is a continuation of Problem 103 in Chapter 10 focusing on depreciation.] Required: For each asset classification, prepare a schedule showing depreciation for

[This problem is a continuation of Problem 10–3 in Chapter 10 focusing on depreciation.]

Required:

For each asset classification, prepare a schedule showing depreciation for the year ended December 31, 2021, using the following depreciation methods and useful lives:

Land improvements—Straight line; 15 years

Building—150% declining balance; 20 years

Equipment—Straight line; 10 years

Automobiles—Units-of-production; $0.50 per mile

Depreciation is computed to the nearest month and whole dollar amount, and no residual values are used. Automobiles were driven 38,000 miles in 2021.

Problem 10–3

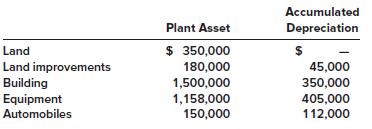

Accumulated Plant Asset Depreciation $ 350,000 Land Land improvements Building Equipment 180,000 45,000 1,500,000 350,000 1,158,000 150,000 405,000 112,000 Automobiles

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

The repaving of the parking lots is considered a repair that doesnt provide ... View full answer

Get step-by-step solutions from verified subject matter experts