Question: Thornhill Equipment (lessor) leased a construction crane to Vanier Construction (lessee) on January 1, 2019. The following information relates to the leased asset and the

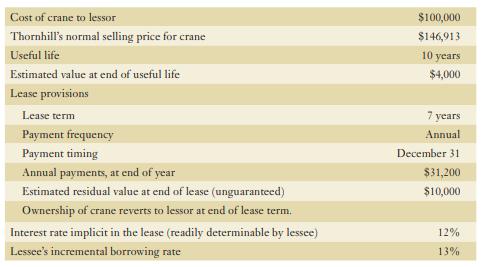

Thornhill Equipment (lessor) leased a construction crane to Vanier Construction (lessee) on January 1, 2019. The following information relates to the leased asset and the lease agreement:

Both companies use the straight-line depreciation method for cranes, and they both have December 31 year ends.

Required:

a. Evaluate how the lessor (Thornhill Equipment) should account for the lease transaction.

b. Prepare a lease amortization schedule for this lease for Thornhill Equipment, the lessor.

c. Prepare a lease amortization schedule for this lease for Vanier Construction, the lessee.

d. Prepare the journal entries on January 1, 2019, and December 31, 2019, for Thornhill Equipment, the lessor.

e. Prepare the journal entries on January 1, 2019, and December 31, 2019, for Vanier Construction, the lessee.

Cost of crane to lessor Thornhill's normal selling price for crane Useful life Estimated value at end of useful life Lease provisions Lease term Payment frequency Payment timing Annual payments, at end of year Estimated residual value at end of lease (unguaranteed) Ownership of crane reverts to lessor at end of lease term. Interest rate implicit in the lease (readily determinable by lessee) Lessee's incremental borrowing rate $100,000 $146,913 10 years $4,000 7 years Annual December 31 $31,200 $10,000 12% 13%

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

a The lessor Thornhill Equipment should account for the lease transaction as a finance lease This is ... View full answer

Get step-by-step solutions from verified subject matter experts