Question: Titan Networking became a public company through an IPO (initial public offering) two weeks ago. You are looking forward to the challenges of being assistant

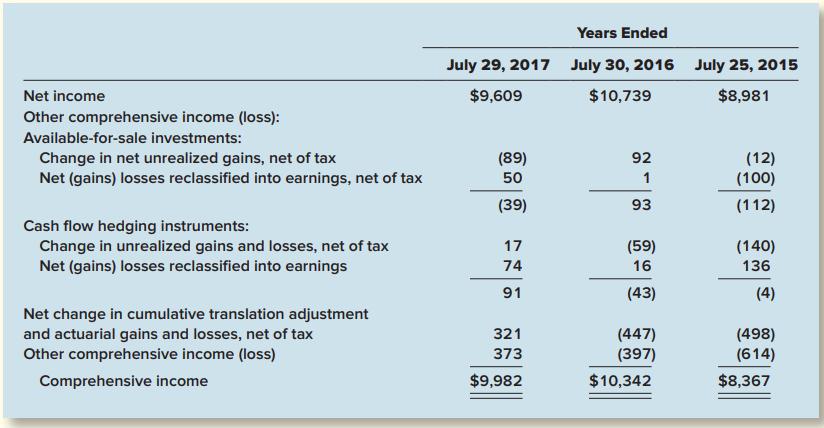

Titan Networking became a public company through an IPO (initial public offering) two weeks ago. You are looking forward to the challenges of being assistant controller for a publicly owned corporation. One such challenge came in the form of a memo in this morning’s in-box. “We need to start reporting comprehensive income in our financials,” the message from your boss said. “Do some research on that, will you? That concept didn’t exist when I went to school.” In response, you sought out the financial statements of Cisco Systems, the networking industry leader. The following are excerpts from disclosure notes from Cisco’s 2017 annual report:

Required:

1. Locate the financial statements of Cisco in the Investor Relations section of Cisco’s website. Search the 2017 annual report for information about how Cisco accounts for comprehensive income. What does Cisco report in its balance sheet for 2017 Accumulated other comprehensive income?

2. From the information Cisco’s financial statements provide, show the calculation of the change in the accumulated other comprehensive income from the end of fiscal 2016 to the end of fiscal 2017. One component of the change is Comprehensive (income) loss attributable to noncontrolling interests.

3. Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Identify the specific eight-digit Codification citation (XXX-XX-XX-X) from the authoritative literature that describes the two alternative formats for reporting comprehensive income.

Years Ended July 29, 2017 July 30, 2016 July 25, 2015 Net income $9,609 $10,739 $8,981 Other comprehensive income (loss): Available-for-sale investments: 92 Change in net unrealized gains, net of tax Net (gains) losses reclassified into earnings, net of tax (89) (12) (100) 50 1 (39) 93 (112) Cash flow hedging instruments: Change in unrealized gains and losses, net of tax Net (gains) losses reclassified into earnings (59) (140) 136 17 74 16 91 (43) (4) Net change in cumulative translation adjustment and actuarial gains and losses, net of tax Other comprehensive income (loss) (447) (397) 321 (498) (614) 373 Comprehensive income $9,982 $10,342 $8,367

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Part 1 To find the figure for accumulated other comprehensive income loss you go to the liabilities ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1965_61d6ac341afa6_828303.pdf

180 KBs PDF File

1965_61d6ac341afa6_828303.docx

120 KBs Word File