Question: Using the information for Vasquez Company in BE17-22, determine the reversal (utilization) of the deferred tax asset for 2021 and 2022. Data from Exercises 22

Using the information for Vasquez Company in BE17-22, determine the reversal (utilization) of the deferred tax asset for 2021 and 2022.

Data from Exercises 22

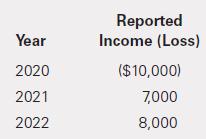

Company, a U.S. corporate filer, provides you with the following information.

The company does not report any book tax differences and is subject to a 21% income tax rate. Compute the NOL carryforward benefit and prepare the journal entry for 2020.

Year 2020 2021 2022 Reported Income (Loss) ($10,000) 7,000 8,000

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Description Taxable income before NOL Carry forward 80 A... View full answer

Get step-by-step solutions from verified subject matter experts