Question: Using the same information from E16-4, assume that Barney Equipment Corporation is an IFRS reporter and the company would like to elect to report these

Using the same information from E16-4, assume that Barney Equipment Corporation is an IFRS reporter and the company would like to elect to report these investments at fair value through other comprehensive income if it qualifies for this treatment. Barney is not holding the investment for trading, not is it part of contingent consideration in a business combination.

Data from E16-4

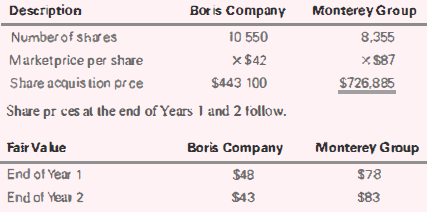

Barney Equipment Corporation acquired the following equity investments at the beginning of Year 1. Barney does not have significant influence over the investees. Both companies are publicly traded.

Required

a. Prepare the journal entry to record the acquisition of the investments.

b. Prepare the journal entry to record the end of Year 1 fair value adjustment.

c. Assume that Barney sells 5,000 Boris Company shares for $50 per share at the beginning of Year 2. Prepare the journal entry required to record the sale. Barney does not correct the fair value adjustment account at this time.

d. Prepare the journal entry to record the end of Year 2 fair value adjustment.

Description Monterey Group Bor is Company Number of shaes 10 550 8,355 X $87 x$42 Marketprice per share $443 100 Share acquis tion pr ce $726,885 Share pr ces al the end of Years I and 2 follow. Fair Va lue Boris Company Monterey Group End of Year 1 $48 $78 End of Year 2 $43 $83

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Under IFRS the company classifies these securities as fair value through other comprehensive income ... View full answer

Get step-by-step solutions from verified subject matter experts