Vickie Plato, accounting clerk in the personnel office of Streisand Corp., has begun to compute pension expense

Question:

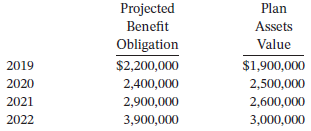

Vickie Plato, accounting clerk in the personnel office of Streisand Corp., has begun to compute pension expense for 2022 but is not sure whether or not she should include the amortization of unrecognized gains/losses. She is currently working with the following beginning-of-the-year present values for the projected benefit obligation and market-related values for the pension plan:

The average remaining service life per employee in 2019 and 2020 is 10 years and in 2021 and 2022 is 12 years. The net gain or loss that occurred during each year is as follows.

2019........................$280,000 loss2020............................85,000 loss2021............................12,000 loss2022............................25,000 gain

(In working the solution, you must aggregate the unrecognized gains and losses to arrive at year-end balances.)

Instructions

You are the manager in charge of accounting. Write a memo to Vickie Plato, explaining why in some years she must amortize some of the net gains and losses and in other years she does not need to. In order to explain this situation fully, you must compute the amount of net gain or loss that is amortized and charged to pension expense in each of the 4 years listed above. Include an appropriate amortization schedule, referring to it whenever necessary.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel