Question: Walmart Inc. is the worlds largest retailer. A large portion of the premises that the company occupies are leased. Its financial statements and disclosure notes

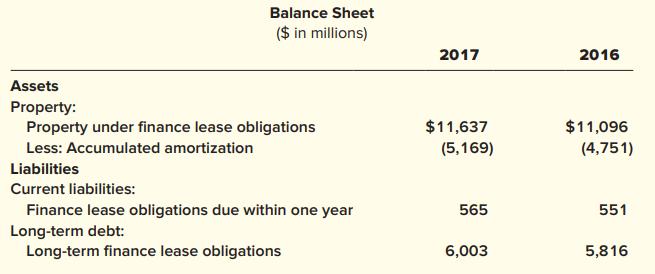

Walmart Inc. is the world’s largest retailer. A large portion of the premises that the company occupies are leased. Its financial statements and disclosure notes revealed the following information:

Required:

1. The net asset “property under finance lease obligations” has a 2017 balance of $6,468 million ($11,637 – $5,169). Liabilities for these leases total $6,568 ($565 + $6,003). Why do the asset and liability amounts differ?

2. Prepare a 2017 summary entry to record Walmart’s lease payments, which were $800 million.

3. What is the approximate average interest rate on Walmart’s finance leases? (Hint: See Req. 2)

4. Discuss some possible reasons why Walmart leases rather than purchases most of its premises.

Balance Sheet ($ in millions) 2017 2016 Assets Property: Property under finance lease obligations $11,637 $11,096 Less: Accumulated amortization (5,169) (4,751) Liabilities Current liabilities: Finance lease obligations due within one year Long-term debt: Long-term finance lease obligations 565 551 6,003 5,816

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Walmart inc Requirement 1 When capital leases are documented first both assets and liabilities rise ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1965_61d6ac341a3b6_828232.pdf

180 KBs PDF File

1965_61d6ac341a3b6_828232.docx

120 KBs Word File