Question: You are in your third year as an accountant with McCarver-Lynn Industries, a multidivisional company involved in the manufacturing, marketing, and sales of surgical prosthetic

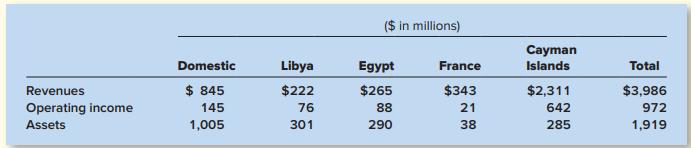

You are in your third year as an accountant with McCarver-Lynn Industries, a multidivisional company involved in the manufacturing, marketing, and sales of surgical prosthetic devices. After the fiscal year-end, you are working with the controller of the firm to prepare geographic area disclosures. Yesterday you presented her with the following summary information:

Upon returning to your office after lunch, you find the following memo:

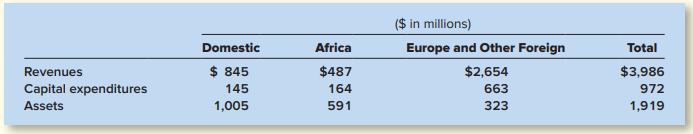

Nice work. Let’s combine the data this way:

Because of political instability in North Africa, let’s not disclose specific countries. In addition, we restructured most of our French sales and some of our U.S. sales to occur through our offices in the Cayman Islands. This allows us to avoid paying higher taxes in those countries. The Cayman Islands has a 0% corporate income tax rate. We don’t want to highlight our ability to shift profits to avoid taxes.

Required:

Do you perceive an ethical dilemma? What would be the likely impact of following the controller’s suggestions? Who would benefit? Who would be injured?

($ in millions) Cayman Islands Domestic Libya Egypt France Total Revenues $ 845 $222 $265 $343 $2,311 $3,986 Operating income 145 76 88 21 642 972 Assets 1,005 301 290 38 285 1,919

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts