Question: You are reviewing the financial statements of Trident Incorporated and observed that Trident entered into a significant operating lease for office equipment at the end

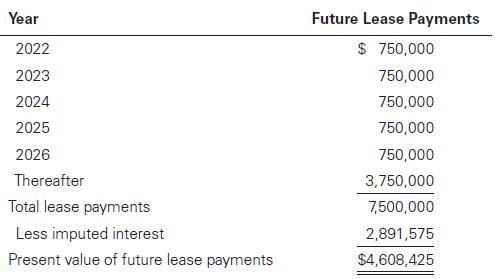

You are reviewing the financial statements of Trident Incorporated and observed that Trident entered into a significant operating lease for office equipment at the end of the current year. Because of the nature of items leased and the length of the lease, you question the classification of the leases as operating. You are interested in assessing the income statement effect of classifying the lease as an operating versus a finance lease. Trident disclosed the following schedule of its lease payments:

Given that lease payments in each of the next 5 years total $750,000, you assume that lease payments going forward are also $750,000 per year. To determine the lease term, you divide the total payments of $3,750,000 after 2026 by $750,000 per year to compute an additional 5 years of lease payments after 2026. Therefore, the total lease term is 10 years. You also determine that Trident’s discount rate is 10%. Use Trident’s information to determine its expenses in 2022, 2023, and 2024 related to its operating lease. Determine what the lease expense would be if Trident classified the lease as a finance lease. Assume lease payments occur at the end of each year.

Year 2022 2023 2024 2025 2026 Thereafter Total lease payments Less imputed interest Present value of future lease payments Future Lease Payments $ 750,000 750,000 750,000 750,000 750,000 3,750,000 7,500,000 2,891,575 $4,608,425

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

We assume that the lease liability and leased rightofuse asset are the same as this is in the early ... View full answer

Get step-by-step solutions from verified subject matter experts