Question: You are the assistant controller for StrongBar Ltd., a company that specializes in making energy bars and other high-protein snacks. The companys CFO, Diana Cash,

James Well, was supposed to provide her the statement of cash flows, but this morning he called in sick. She is wondering if you can prepare the report for her. She remembers that yesterday Mr. Well started working on the report and suggests that you check his desk for his notes. You tell Ms. Cash that you will try to help her, and promise to update her in few hours. Nervously you walk to Mr. Well€™s office and, searching his desk, you find the following information.

Additional information:

1. In the beginning of 2016 StrongBar had 20,000 shares outstanding.

2. On March 1, the company declared and distributed a 5% stock dividend. At that date StrongBar€™s shares were trading for $10.

3. A cash dividend of $18,000 was declared and paid in October 2016.

4. On May 1, the company issued common shares for cash.

5. On January 1, 2016, StrongBar extinguished all of its outstanding bonds and replaced them with a new issue of convertible bonds. The old bonds had a face value of 150,000. To induce the retirement of the bonds, it offered bondholders $10,000 above the market value of the bonds. At that date the bonds were trading at .99. On the same day StrongBar issued 150,000, 9%, five-year convertible bonds. The bonds pay interest annually on December 31 each year. Similar bonds without conversion options are traded to yield 8%. The company does not remember what the proceeds from the issue were, but the controller€™s notes say that the fair value of the conversion rights at issuance was $25,000. Because the terms of the old bonds and the new bonds were substantially different, those transactions are not considered a modification of debt.

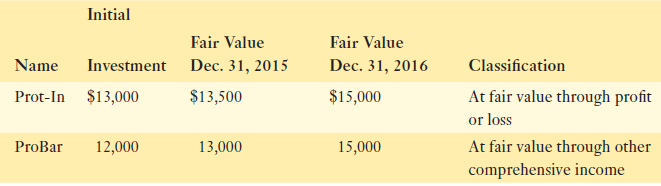

6. StrongBar has two investments, as follows:

7. In 2016 the company sold plant assets with a gross book value of $30,000 and accumulated depreciation of $25,000. There was no gain or loss on the sale.

One thing that you are unable to locate is the income statement or information about the company€™s net income. At first you are worried that this will mean you will not be able to prepare the statement of cash flows. However, after carefully examining the information, you feel relief as you realize that this is not going to be a problem, and you start preparing the report.

StrongBar is a public Canadian company located in Vancouver. StrongBar uses the indirect method for reporting the operating activities section of the statement of cash flows. StrongBar€™s policy is to classify interest expense as an operating activity, dividends paid as a financing activity, and interest and dividends received as investing activities.

Required:

1. Explain how it is possible to prepare the statement of cash flows without having the income statement.

2. Prepare the statement of cash flows. Assume that the bond premium is included in the same category as the underlying interest expense. Ignore the disclosure requirements pertaining to interest and dividends paid and received; income taxes paid; and material non-cash transactions.

3. Now assume that the company classified the dividends paid as an operating activity. Without regenerating the entire report again, explain what will change in the statement of cash flows. Be specific.

4. Suppose investors are unaware that companies can choose how to classify interest expense and dividends paid. How can this affect their assessment of StrongBar€™s statement of cash flows?

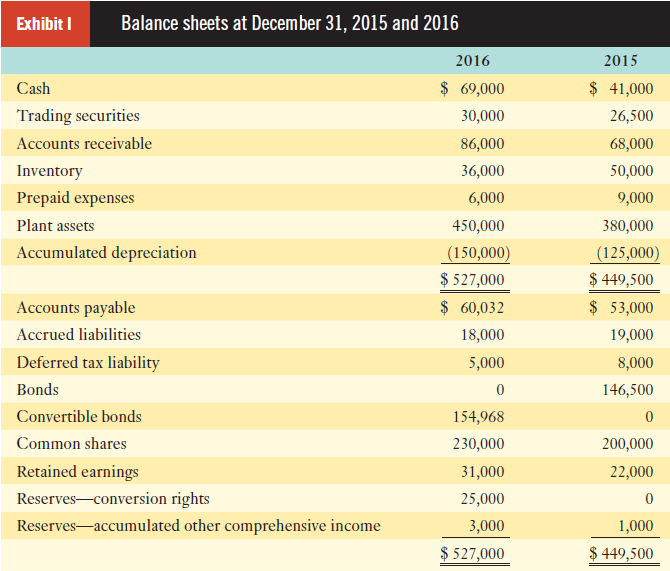

Balance sheets at December 31, 2015 and 2016 Exhibit I 2015 2016 $ 69,000 $ 41,000 Cash Trading securities 30,000 26,500 Accounts receivable 86,000 68,000 36,000 Inventory 50,000 Prepaid expenses 6,000 9,000 Plant assets 450,000 380,000 Accumulated depreciation |(150,000) $ 527,000 (125,000) $ 449,500 $ 60,032 $ 53,000 Accounts payable Accrued liabilities 18,000 19,000 Deferred tax liability 5,000 8,000 Bonds 146,500 Convertible bonds 154,968 Common shares 230,000 200,000 Retained earnings 31,000 22,000 Reserves-conversion rights 25,000 Reserves-accumulated other comprehensive income 3,000 1,000 $ 527,000 $ 449,500 Initial Fair Value Investment Dec. 31, 2015 Fair Value Name Dec. 31, 2016 Classification At fair value through profit or loss At fair value through other comprehensive income Prot-In $13,000 $13,500 $15,000 ProBar 15,000 12,000 13,000

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

1 Net income as reported on the income statement is the normal starting point for preparing the statement of cash flows using the indirect method While you do not have the income statement sufficient ... View full answer

Get step-by-step solutions from verified subject matter experts