You are the external auditor of Iron Company. During the 2021 year-end audit, the following items come

Question:

You are the external auditor of Iron Company.

During the 2021 year-end audit, the following items come to your attention:

1. On January 1, 2018, the company capitalized an amount of $90,000 related to interest on a loan it took to finance the construction of a production asset it fabricated by itself. Because the asset was completed by the end of 2017 and immediately became productive, the interest should have been expensed. The company has depreciated the asset using the straight-line method since January 1, 2018, assuming a six-year life, and no residual value. This issue was discovered after depreciation for 2021 was recorded.

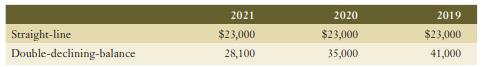

2. During 2021, Iron changed from the straight-line method of depreciating its machinery to the double-declining-balance method. The following calculations present depreciation on both bases:

The net income for 2021 already reflects the double-declining-balance method.

3. Iron, in reviewing its provision for uncollectible accounts during 2021, has determined that 2% is the appropriate amount of bad debt expense to be charged to operations. The company had used 1% as its rate in 2020 and 2019 when the expense had been $9,000 and $6,000, respectively. The company recorded bad debt expense under the new rate for 2021. The company would have recorded $3,000 less of bad debt expense on December 31, 2021, under the old rate.

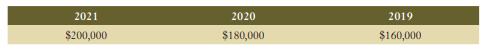

Net income for the most recent three years is presented below:

Required:

a. Prepare, in general journal form, the entries necessary to correct the books for the transactions described above, assuming that the books have not been closed for the current year. Describe the situation for each transaction and support the appropriate accounting treatment according to GAAP, if any, for the change. Ignore all income tax effects.

b. Present comparative income statement data for the years 2019 to 2021, starting with income before cumulative effect of accounting changes and adjusting the net income balance based on your analysis in part (a).

c. Assume that the beginning retained earnings balance (unadjusted) for 2021 is $800,000 and that non-comparative financial statements are prepared. Show the adjusted amount of the beginning retained earnings balance.

d. Suppose that, when you looked into the increase in the estimates of uncollectible accounts, you learned that by 2019 all other companies in Iron Company’s industry were using 2%. Would this change your treatment of the change? Explain (no need to provide calculations).

Step by Step Answer: