Question: For each asset classification, prepare a schedule showing depreciation for the year ended December 31, 2024, using the following depreciation methods and useful lives: Depreciation

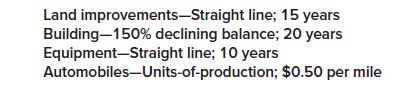

For each asset classification, prepare a schedule showing depreciation for the year ended December 31, 2024, using the following depreciation methods and useful lives:

Depreciation is computed to the nearest month and whole dollar amount, and no residual values are used. Automobiles were driven 38,000 miles in 2024.

Land improvements-Straight line; 15 years Building-150% declining balance; 20 years Equipment Straight line; 10 years Automobiles-Units-of-production; $0.50 per mile

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Depreciation schedule for the year ended December 31 2024 Land Impr... View full answer

Get step-by-step solutions from verified subject matter experts