For financial reporting, Kumas Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired

Question:

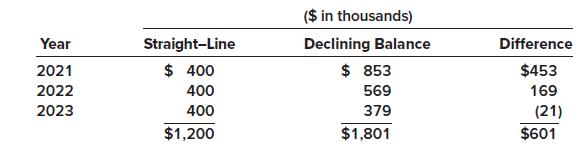

For financial reporting, Kumas Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2021 for $2,560,000. Its useful life was estimated to be six years with a $160,000 residual value. At the beginning of 2024, Kumas decides to change to the straight-line method. The effect of this change on depreciation for each year is as follows:

Required:

1. Will Kumas apply the straight-line method retrospectively or apply the straight-line method prospectively?

2. Prepare any 2024 journal entry related to the change.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: