Question: Im so confused, your study partner snarls, throwing up his hands in exasperation. As part of our teams group project, I need to find out

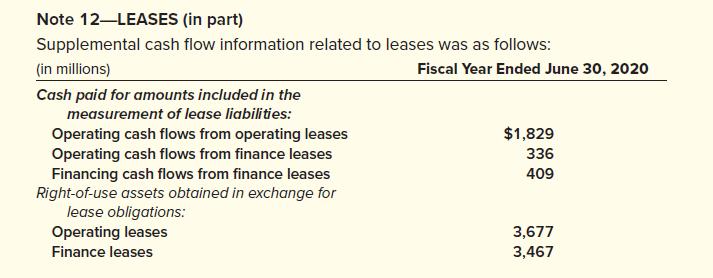

“I’m so confused,” your study partner snarls, throwing up his hands in exasperation. “As part of our team’s group project, I need to find out how much cash Microsoft spent on leases last year, and their statement of cash flows doesn’t even mention leases.” Tossing a sheet of paper in front of you, he mutters, “I found this disclosure note to their financial statements that promises ‘supplemental cash flow information related to leases,’ but it just confuses me more. I think I know the difference between operating leases and finance leases, but why are there operating cash flows for both types, but only financing cash flows for finance leases? And why are new leases listed in connection with cash flows? Did they pay all this cash in addition to incurring lease liabilities for the right-of-use assets? You’re the accounting major; help me out here.” Eager to show off what you learned in Intermediate Accounting, you pick up the disclosure note:

Required:

1. Why are there are operating cash flows for both types of leases, but only financing cash flows for finance leases?

2. To aid in your explanation, prepare a journal entry that summarizes the cash payments for operating leases during the year.

3. To aid in your explanation, prepare a journal entry that summarizes the cash payments for finance leases during the year.

4. Did Microsoft pay the amounts indicated in addition to incurring lease liabilities for the right-of-use assets for finance leases and operating leases? Why or why not?

5. To aid in your explanation, prepare a journal entry that summarizes the acquisition of assets by operating leases during the year.

Note 12-LEASES (in part) Supplemental cash flow information related to leases was as follows: (in millions) Cash paid for amounts included in the measurement of lease liabilities: Operating cash flows from operating leases Operating cash flows from finance leases Financing cash flows from finance leases Right-of-use assets obtained in exchange for lease obligations: Operating leases Finance leases Fiscal Year Ended June 30, 2020 $1,829 336 409 3,677 3,467

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Requirement 1 The lessee reports operating lease rent payments both the interest and liability porti... View full answer

Get step-by-step solutions from verified subject matter experts