Question: In this simulation, you will be asked to compute various income amounts. Assume a tax rate of 30% and 100,000 shares of common stock outstanding

In this simulation, you will be asked to compute various income amounts. Assume a tax rate of 30%

and 100,000 shares of common stock outstanding during the year. Prepare responses to all parts.

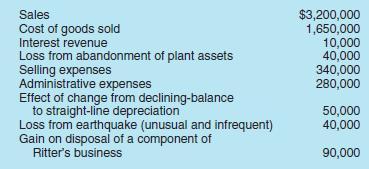

Ritter Corporation provides you with the following pre-tax information for the period.

Explain the proper accounting treatment for loss on abandonment of plant assets and gain on disposal of a component of a business Measurement Compute the following five items.

(a) Gross profit.

(b) Income from operations.

(c) Income from continuing operations before income taxes.

(d) Net income.

(e) Earnings per share

Sales $3,200,000 Cost of goods sold 1,650,000 Interest revenue 10,000 Loss from abandonment of plant assets 40,000 Selling expenses 340,000 Administrative expenses 280,000 Effect of change from declining-balance to straight-line depreciation 50,000 Loss from earthquake (unusual and infrequent) 40,000 Gain on disposal of a component of Ritter's business 90,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts