Question: Income statement and balance sheet information abstracted from a recent annual report of Wolverine World Wide, Inc., appears below: The significant accounting policies note disclosure

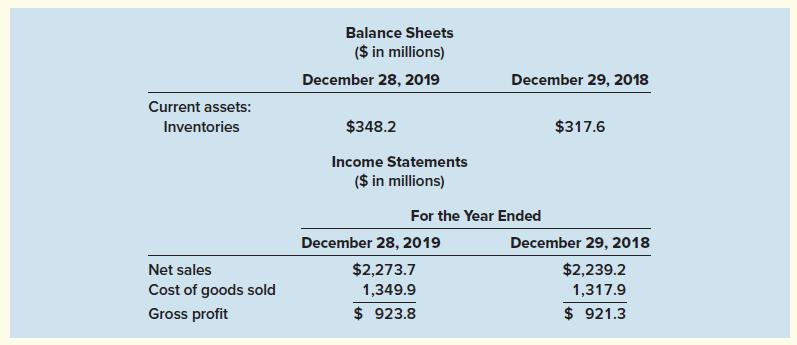

Income statement and balance sheet information abstracted from a recent annual report of Wolverine World Wide, Inc., appears below:

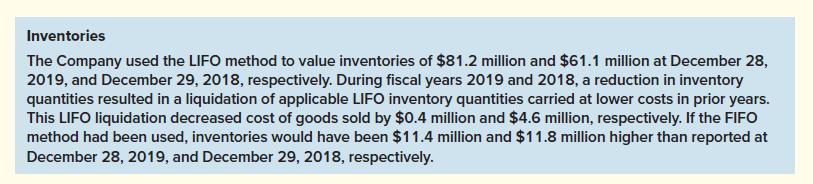

The significant accounting policies note disclosure contained the following:

Required:

1. Is Wolverine disclosing the FIFO cost of its LIFO inventory?

2. Calculate what beginning inventory and ending inventory would have been for the year ended December 28, 2019, if Wolverine had used FIFO for all of its inventories.

3. Calculate what cost of goods sold and gross profit would have been for the year ended December 28, 2019, if Wolverine had used FIFO for all of its inventories.

4. In 2019, Wolverine reported a LIFO liquidation. Did this liquidation increase or decrease cost of goods sold in 2019? Does this indicate that inventory costs have been increasing or decreasing over time?

Current assets: Inventories Net sales Cost of goods sold Gross profit Balance Sheets ($ in millions) December 28, 2019 $348.2 Income Statements ($ in millions) December 29, 2018 $317.6 December 29, 2018 $2,239.2 1,317.9 $921.3 For the Year Ended December 28, 2019 $2,273.7 1,349.9 $923.8

Step by Step Solution

3.56 Rating (170 Votes )

There are 3 Steps involved in it

Requirement 1 Yes The LIFO conformity rule permits LIFO users to present disclosures that report in ... View full answer

Get step-by-step solutions from verified subject matter experts