Question: Listed below are ten independent situations. For each situation indicate (by letter) whether it will create a deferred tax asset (A), a deferred tax liability

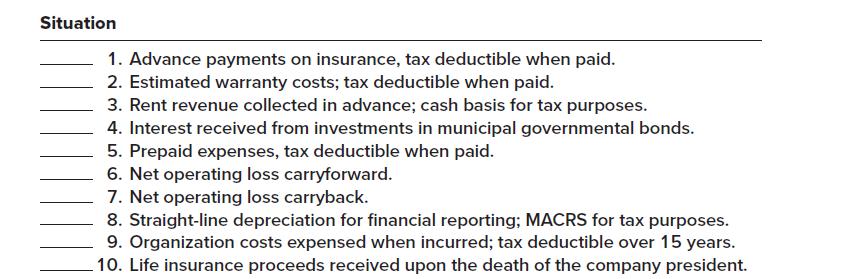

Listed below are ten independent situations. For each situation indicate (by letter) whether it will create a deferred tax asset (A), a deferred tax liability (L), or neither (N).

Situation 1. Advance payments on insurance, tax deductible when paid. 2. Estimated warranty costs; tax deductible when paid. 3. Rent revenue collected in advance; cash basis for tax purposes. 4. Interest received from investments in municipal governmental bonds. 5. Prepaid expenses, tax deductible when paid. 6. Net operating loss carryforward. 7. Net operating loss carryback. 8. Straight-line depreciation for financial reporting; MACRS for tax purposes. 9. Organization costs expensed when incurred; tax deductible over 15 years. 10. Life insurance proceeds received upon the death of the company president.

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

L 1 Advance payments on insurance tax deductible when paid A ... View full answer

Get step-by-step solutions from verified subject matter experts