Question: Microsofts 2020 10-K includes the following information relevant to its available-for-sale investments in Note 17Accumulated Other Comprehensive Income (Loss): Required: 1. Prepare a journal entry

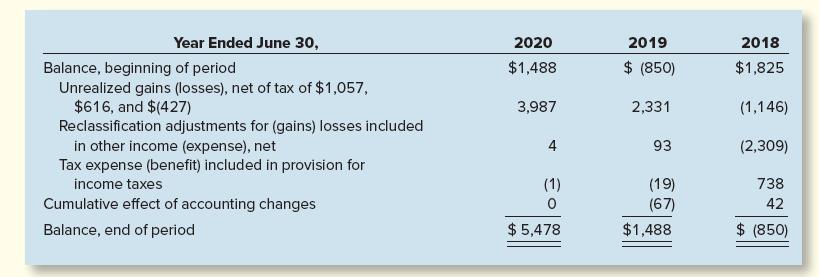

Microsoft’s 2020 10-K includes the following information relevant to its available-for-sale investments in Note 17—Accumulated Other Comprehensive Income (Loss):

Required:

1. Prepare a journal entry to record unrealized gains for 2020. (Hint: $3,987 is net of tax effects, so you will need to add back tax effects to show the amount of pretax unrealized gain.)

2. Prepare a journal entry to record Microsoft’s reclassification adjustment for 2020 (pretax).

Year Ended June 30, Balance, beginning of period Unrealized gains (losses), net of tax of $1,057, $616, and $(427) Reclassification adjustments for (gains) losses included in other income (expense), net Tax expense (benefit) included in provision for income taxes Cumulative effect of accounting changes Balance, end of period 2020 $1,488 3,987 4 (1) 0 $5,478 2019 $ (850) 2,331 93 (19) (67) $1,488 2018 $1,825 (1,146) (2,309) 738 42 $ (850)

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

1 Journal entry to record unrealized gains for 2020 Debit Availableforsale i... View full answer

Get step-by-step solutions from verified subject matter experts