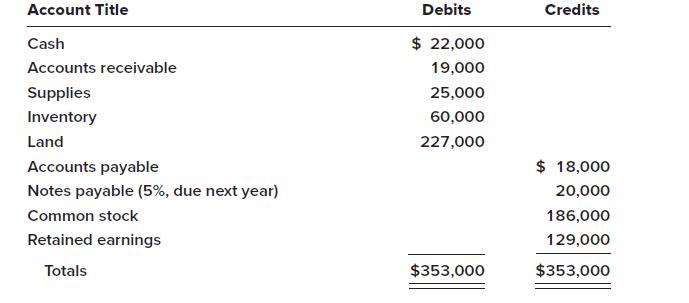

On January 1, 2024, Displays Incorporated had the following account balances: From January 1 to December 31,

Question:

On January 1, 2024, Displays Incorporated had the following account balances:

From January 1 to December 31, the following summary transactions occurred:

a. Purchased inventory on account for $330,000.

b. Sold inventory on account for $570,000. The cost of the inventory sold was $310,000.

c. Received $540,000 from customers on accounts receivable.

d. Paid freight on inventory received, $24,000.

e. Paid $320,000 to inventory suppliers on accounts payable of $325,000. The difference reflects purchase discounts of $5,000.

f. Paid rent for the current year, $42,000. The payment was recorded to Rent Expense.

g. Paid salaries for the current year, $150,000. The payment was recorded to Salaries Expense.

Required:

1. Record each of the transactions listed above in the “General Journal” tab (these are shown as items 1–8), assuming a perpetual inventory system. Review the “General Ledger” and the “Trial Balance” tabs to see the effect of the transactions on the account balances.

2. Record adjusting entries on December 31 in the “General Journal” tab (these are shown as items 9–11).

a. Supplies on hand at the end of the year are $8,000.

b. Accrued interest expense on notes payable for the year.

c. Accrued income taxes at the end of December are $18,000.

3. Review the adjusted “Trial Balance” as of December 31, 2024, in the “Trial Balance” tab.

4. Prepare a multiple-step income statement for the period ended December 31, 2024, in the “Income Statement” tab.

5. Prepare a classified balance sheet as of December 31, 2024, in the “Balance Sheet” tab.

6. Record the closing entries in the “General Journal” tab (these are shown as items 12–13).

7. Using the information from the requirements above, complete the “Analysis” tab.

a. Suppose Displays Incorporated decided to maintain its internal records using FIFO but to use LIFO for external reporting. Assuming the ending balance of inventory under LIFO would have been $85,000, calculate the LIFO reserve.

b. Assume the $60,000 beginning balance of inventory comes from the base year with a cost index of 1.00. The cost index at the end of 2024 of 1.10. Calculate the amount the company would report for inventory using dollar-value LIFO.

c. Indicate whether each of the following amounts below would be higher or lower when reporting inventory using LIFO (or dollar-value LIFO) instead of FIFO in periods of rising inventory costs and stable inventory quantities: Inventory turnover ratio, average days in inventory, gross profit ratio.

Step by Step Answer: