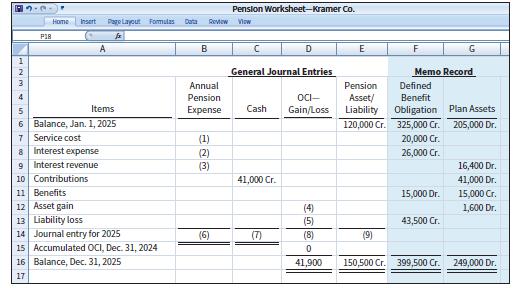

Question: P19.10 (LO 2, 4) (Pension WorksheetMissing Amounts) Kramer Co. has prepared the following pension worksheet (amounts in $). Unfortunately, several entries in the worksheet are

P19.10 (LO 2, 4) (Pension Worksheet—Missing Amounts) Kramer Co. has prepared the following pension worksheet (amounts in $). Unfortunately, several entries in the worksheet are not decipherable.

The company has asked your assistance in completing both the worksheet and the accounting tasks related to the pension plan for 2025.

Instructions

a. Determine the missing amounts in Kramer’s 2025 pension worksheet, indicating whether the amounts are debits or credits.

b. Prepare the journal entry to record 2025 pension expense.

c. Determine for 2025 the discount rate used to determine interest expense/revenue.

-- P18 Home Insert Page Layout Formulas Data Review x Pension Worksheet-Kramer Co. Vow A B D E F 1 2 3 4 General Journal Entries Memo Record Annual Pension Defined Pension OCI- Asset/ Benefit 5 Items Expense Cash Gain/Loss Liability Obligation Plan Assets 6 Balance, Jan. 1, 2025 120,000 Cr. 325,000 Cr. 205,000 Dr. 7 Service cost (1) 20,000 Cr. 8 Interest expense (2) 26,000 Cr. 9 Interest revenue (3) 16,400 Dr. 10 Contributions 41,000 Cr. 41,000 Dr. 11 Benefits 15,000 Dr. 15,000 Cr. 12 Asset gain (4) 1,600 Dr. 13 Liability loss (5) 43,500 Cr. 14 Journal entry for 2025 (6) (7) (8) (9) 15 Accumulated OCI, Dec. 31, 2024 0 16 Balance, Dec. 31, 2025 41,900 150,500 Cr. 399,500 Cr. 249,000 Dr. 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts