Question: Presented below are condensed financial statements adapted from those of two actual companies competing in the pharmaceutical industryJohnson and Johnson (J&J) and Pfizer, Inc. ($

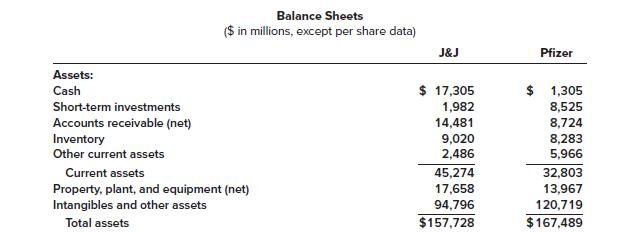

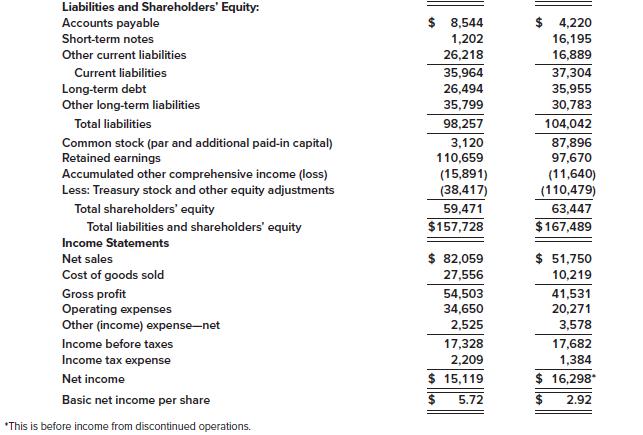

Presented below are condensed financial statements adapted from those of two actual companies competing in the pharmaceutical industry—Johnson and Johnson (J&J) and Pfizer, Inc. ($ in millions, except per share amounts).

Required:

Evaluate and compare the two companies by responding to the following questions. Note: Because two-year comparative statements are not provided, you should use year-end balances in place of average balances as appropriate.

1. Which of the two companies appears more efficient in collecting its accounts receivable and managing its inventory?

2. Which of the two firms had greater earnings relative to resources available?

3. Have the two companies achieved their respective rates of return on assets with similar combinations of profit margin and turnover?

4. From the perspective of a common shareholder, which of the two firms provided a greater rate of return?

5. From the perspective of a common shareholder, which of the two firms appears to be using leverage more effectively to provide a return to shareholders above the rate of return on assets?

Balance Sheets ($ in millions, except per share data) Assets: Cash Short-term investments Accounts receivable (net) Inventory Other current assets Current assets Property, plant, and equipment (net) Intangibles and other assets Total assets J&J $ 17,305 1,982 14,481 9,020 2,486 45,274 17,658 94,796 $157,728 $ Pfizer 1,305 8,525 8,724 8,283 5,966 32,803 13,967 120,719 $167,489

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Requirement 1 Receivables turnover JJ Pfizer JJ 11 Pfizer Average collection period Net sales Accoun... View full answer

Get step-by-step solutions from verified subject matter experts