Refer to the information in P20-4. Follow the instructions under the assumption that Situ Ltd. follows IAS

Question:

Refer to the information in P20-4. Follow the instructions under the assumption that Situ Ltd. follows IAS 17.

Data From P20-4:

Refer to the information in P20-3.

Instructions

(a) Prepare the journal entries that Situ would make on January 1, 2017 and the adjusting journal entries at December 31,2017, to record the annual interest income from the lease arrangement, assuming that Situ has a December 31fiscal year end.

(b) Identify all accounts that will be reported by Situ Ltd. on its comparative statement of income for the fiscal yearsending December 31, 2018 and 2017, and its comparative statement of financial position at December 31, 2018 and2017. Be specific about the classifications in each statement.

(c) Prepare a partial comparative statement of cash flows for Situ for the years ended December 31, 2018 and 2017, forall transactions related to the information in P20-3. Be specific about the classifications in the financial statement.Assume that situ has opted to report interest received as operating activities.

Data From P20-3:

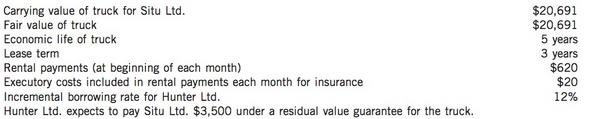

On January 1, 2017, Hunter Ltd. entered into an agreement to lease a truck from Situ Ltd. Both Hunter and Situ use IFRS 16. The details of the agreement are as follows:

Additional information:

1. There are no abnormal risks associated with the collection of lease payments from Hunter.

2. There are no additional unreimbursable costs to be incurred by Situ in connection with the leased truck.

3. At the end of the lease term, Situ sold the truck to a third party for $3,200, which was the truck's fair value at December 31, 2019. Hunter paid Situ the difference between the residual value guarantee of $3,500 and the proceeds obtained on the resale.

4. Hunter knows the interest rate that is implicit in the lease.

5. Hunter knows the amount of executory costs included in the minimum lease payments.

6. Hunter uses straight-line depreciation for its trucks with the residual value guarantee of $3,500 for the leased truck.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119048541

11th Canadian edition Volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Nicola M. Young, Irene M. Wiecek, Bruce J. McConomy