Question: Refer to the situation described in E 1127. Data from in E 11-27 Chadwick Enterprises, Inc., operates several restaurants throughout the Midwest. Three of its

Refer to the situation described in E 11–27.

Data from in E 11-27

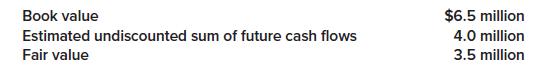

Chadwick Enterprises, Inc., operates several restaurants throughout the Midwest. Three of its restaurants located in the center of a large urban area have experienced declining profits due to declining population. The company’s management has decided to test the assets of the restaurants for possible impairment. The relevant information for these assets is presented below at the end of 2024.

Required:

How might your solution differ if Chadwick Enterprises, Inc., prepares its financial statements according to International Financial Reporting Standards? Assume that the fair value amount given in the exercise equals both

(a) the fair value less costs to sell and (b) the present value of estimated future cash flows.

Book value Estimated undiscounted sum of future cash flows Fair value $6.5 million 4.0 million 3.5 million

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Requirement 1 IFRS requires an impairment loss to be recognized when an assets book value exceeds th... View full answer

Get step-by-step solutions from verified subject matter experts