The following are excerpts from the 2019 financial statements of Renault, a large French automobile manufacturer. In

Question:

The following are excerpts from the 2019 financial statements of Renault, a large French automobile manufacturer.

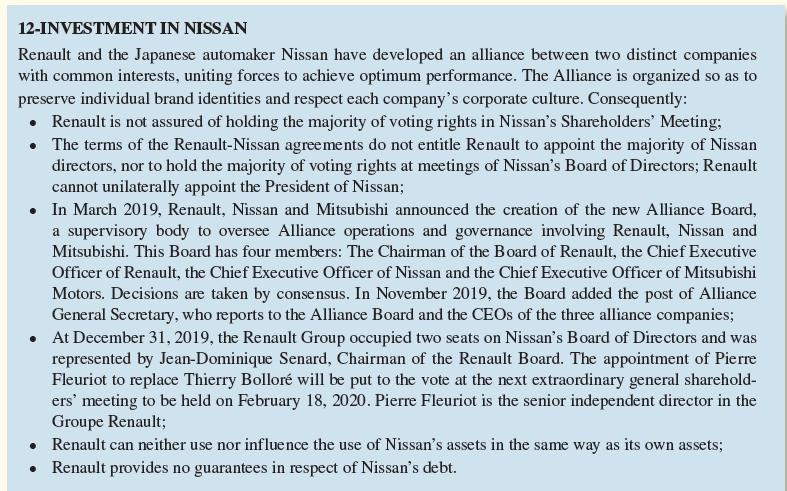

In view of this situation, Renault is considered to exercise significant influence over Nissan, and therefore uses the equity method to include its investment in Nissan in the consolidation. Renault’s Note 12-D lists various restatements that Renault makes when accounting for its Nissan investment under the equity method. Some of those changes harmonize Nissan’s accounting (under Japanese accounting standards). Others reflect adjustments to fair value of assets and liabilities applied by Renault at the time of acquisitions in 1999 and 2002.

Required:

1. Go to Deloitte’s IAS Plus website and examine the summary of the IASB’s IAS No. 28 (https://www.iasplus.com/en/standards/ias/ias28-2011), which governs application of the equity method. Focus on two areas: Identification of Associates and Applying the Equity Method of Accounting.

2. Evaluate Renault’s decision to use the equity method to account for its investment in Nissan. Does Renault have insignificant influence, significant influence, or control?

3. Evaluate the fact that, when accounting for its investment in Nissan under the equity method, Renault makes adjustments that take into account the fair value of assets and liabilities at the time Renault invested in Nissan. Give an example of the sorts of adjustments that might be made. Are such adjustments consistent with IFRS? With U.S. GAAP? Explain.

4. Evaluate the fact that, when accounting for its investment in Nissan under the equity method, Renault makes adjustments for harmonization of accounting standards. Are such adjustments consistent with IFRS? With

U.S. GAAP? Explain.

Step by Step Answer: