The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30 and December

Question:

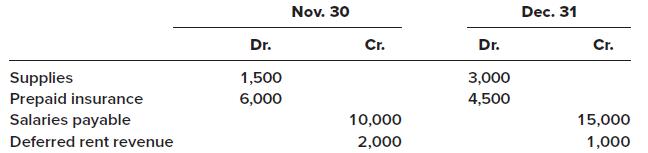

The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30 and December 31, 2024, trial balances contained the following account information:

The following information also is known:

a. The December income statement reported $2,000 in supplies expense.

b. No insurance payments were made in December.

c. $10,000 was paid to employees during December for salaries.

d. On November 1, 2024, a tenant paid Righter $3,000 in advance rent for the period November through January. Deferred rent revenue was credited at the time cash was received.

Required:

1. What was the cost of supplies purchased during December?

2. What was the adjusting entry recorded at the end of December for prepaid insurance?

3. What was the adjusting entry recorded at the end of December for accrued salaries?

4. What was the amount of rent revenue recognized in December? What adjusting entry was recorded at the end of December for deferred rent revenue?

Step by Step Answer: