Question: PI and IRR can be interpreted as measuring a project's bang for the buck as well as its margin for error. Consider Projects A and

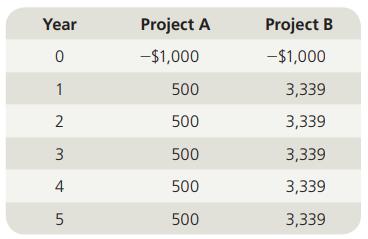

PI and IRR can be interpreted as measuring a project's "bang for the buck" as well as its "margin for error." Consider Projects A and B, below. The WACC is 10%.

a. Calculate the NPV, IRR, and PI for each project. What can you conclude about the two projects?

b. Suppose the outflow at Year 0 is correct but the inflows in Years 1 — 4 are 10% smaller than originally forecast. What can you conclude about the two projects now? Why did this happen?

Year 0 1 2 3 4 5 Project A -$1,000 500 500 500 500 500 Project B - $1,000 3,339 3,339 3,339 3,339 3,339

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

a IRR Using a financial calculator input the following CF0 1000 CF1 500 F1 4 and IRR to solve for IR... View full answer

Get step-by-step solutions from verified subject matter experts