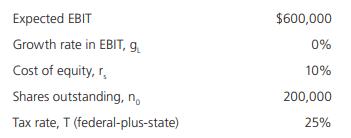

The Rivoli Company has no debt outstanding, and its financial position is given by the following data:

Question:

The Rivoli Company has no debt outstanding, and its financial position is given by the following data:

a. What is Rivoli’s intrinsic value of operations (i.e., its unlevered value)? What is its intrinsic stock price? Its earnings per share?

b. Rivoli is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 12% to reflect the increased risk. Bonds can be sold at a cost, rd, of 7%. Based on the new capital structure, what is the new weighted average cost of capital? What is the levered value of the firm? What is the amount of debt?

c. Based on the new capital structure, what is the new stock price? What is the remaining number of shares? What is the new earnings per share?

Step by Step Answer:

Intermediate Financial Management

ISBN: 9780357516669

14th Edition

Authors: Eugene F Brigham, Phillip R Daves